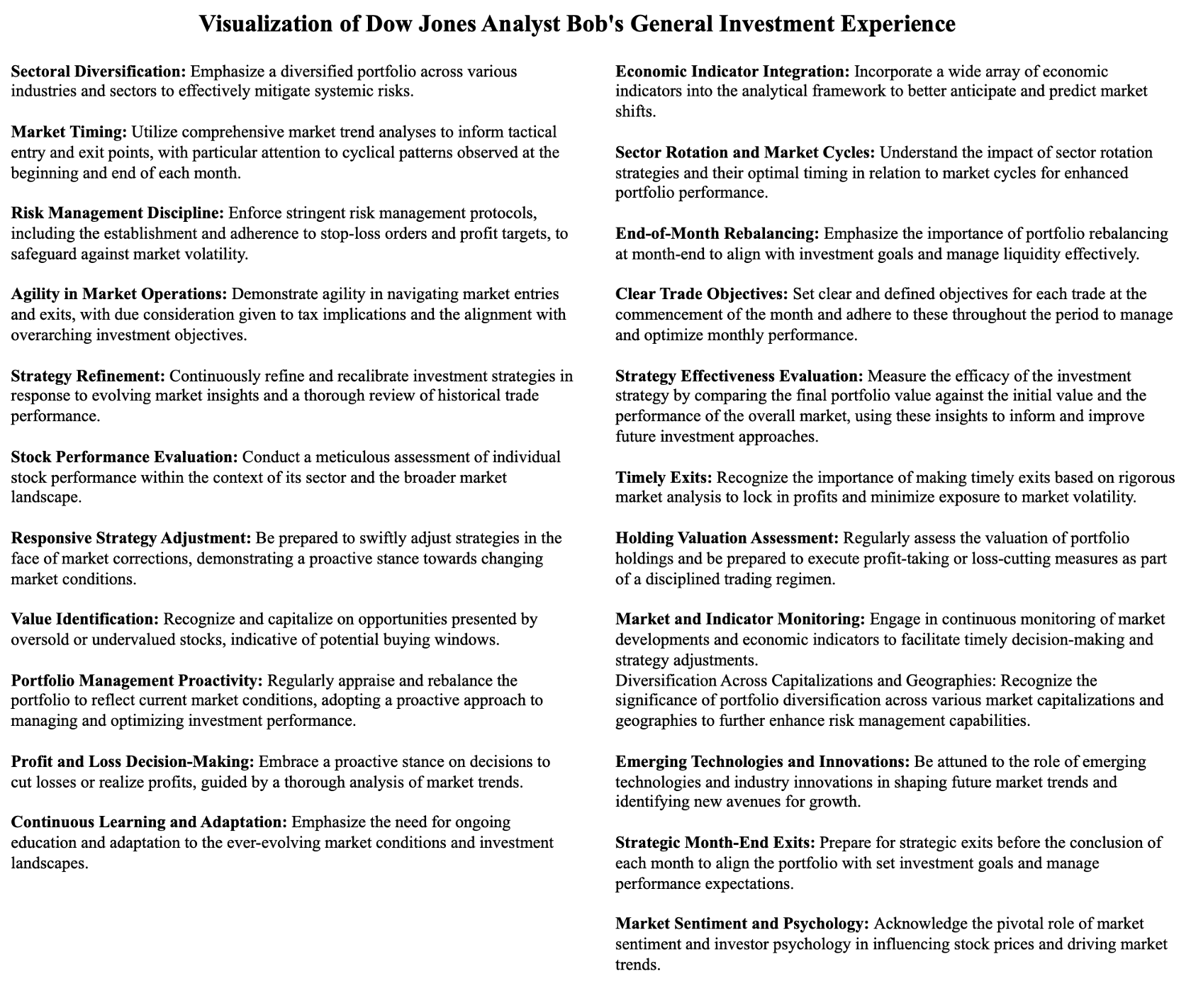

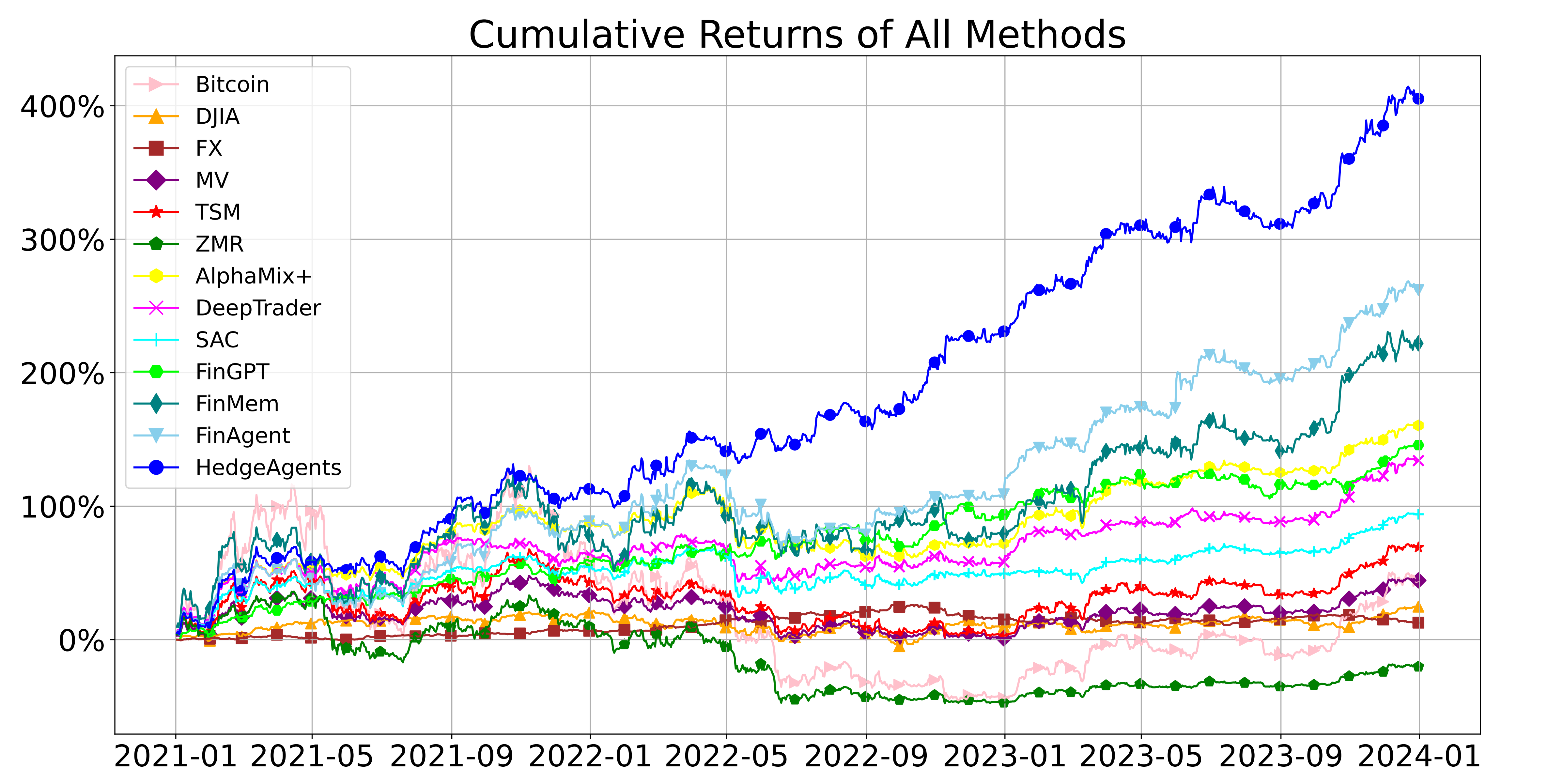

Leaderboard on Multi-Asset Financial Dataset

Leaderboard for evaluating various methods on 9 metrics in the Multi-Asset Financial Dataset.

| # | Models | Categories | Source | ARR(%) | TR(%) | SR | CR | SoR | MDD(%) | Vol(%) | ENT | ENB |

| 1 | HedgeAgents 🥇 | LLM-based 👑️ | Link | 71.60 | 405.34 | 2.41 | 11.02 | 58.00 | 14.21 | 1.30 | 3.13 | 1.53 |

| 2 | FinAgent 🥈 | LLM-based 👑️ | Link | 53.54 | 261.98 | 1.80 | 4.52 | 39.12 | 28.24 | 1.42 | 2.85 | 1.41 |

| 3 | FinMem 🥉 | LLM-based 👑️ | Link | 47.67 | 221.99 | 1.20 | 4.02 | 25.42 | 32.39 | 2.16 | 1.99 | 1.25 |

| 4 | AlphaMix+ | RL-Based 🎮 | Link | 37.59 | 160.47 | 1.62 | 3.69 | 35.52 | 25.56 | 1.17 | 2.93 | 1.22 |

| 5 | FinGPT | LLM-based 👑️ | Link | 34.22 | 141.82 | 1.93 | 7.64 | 39.57 | 17.08 | 8.76 | 1.76 | 1.33 |

| 6 | DeepTrader | RL-based 🎮 | Link | 32.78 | 134.11 | 1.41 | 4.06 | 30.43 | 20.95 | 1.21 | 2.02 | 1.30 |

| 7 | SAC | RL-based 🎮 | Link | 24.71 | 93.94 | 1.16 | 3.12 | 23.15 | 21.56 | 1.16 | 1.62 | 1.14 |

| 8 | TSM | Rule-Based 🛠️ | Link | 19.13 | 69.09 | 0.78 | 1.53 | 18.21 | 39.14 | 1.55 | 1.10 | 1.09 |

| 9 | MV | Rule-Based 🛠 | Link | 13.03 | 44.39 | 0.71 | 1.25 | 16.14 | 32.04 | 1.13 | 1.09 | 1.02 |

| 10 | ZMR | Rule-Based 🛠 | Link | -7.25 | -20.21 | -0.52 | -3.13 | -5.15 | 61.52 | 1.98 | 1.55 | 1.11 |

🚨 The Multi-Asset Financial Dataset comprising Bitcoin, foreign exchange, and the Dow Jones component stocks. These data were sourced from reputable financial databases, namely Yahoo Finance and the Alpaca News API. The dataset spans from January 1, 2015, to December 31, 2023, encompassing daily data points such as open, high, low, and close prices, as well as volume and adjusted close prices. Additionally, daily news updates and 60 standard technical analysis indicators are included for each asset .

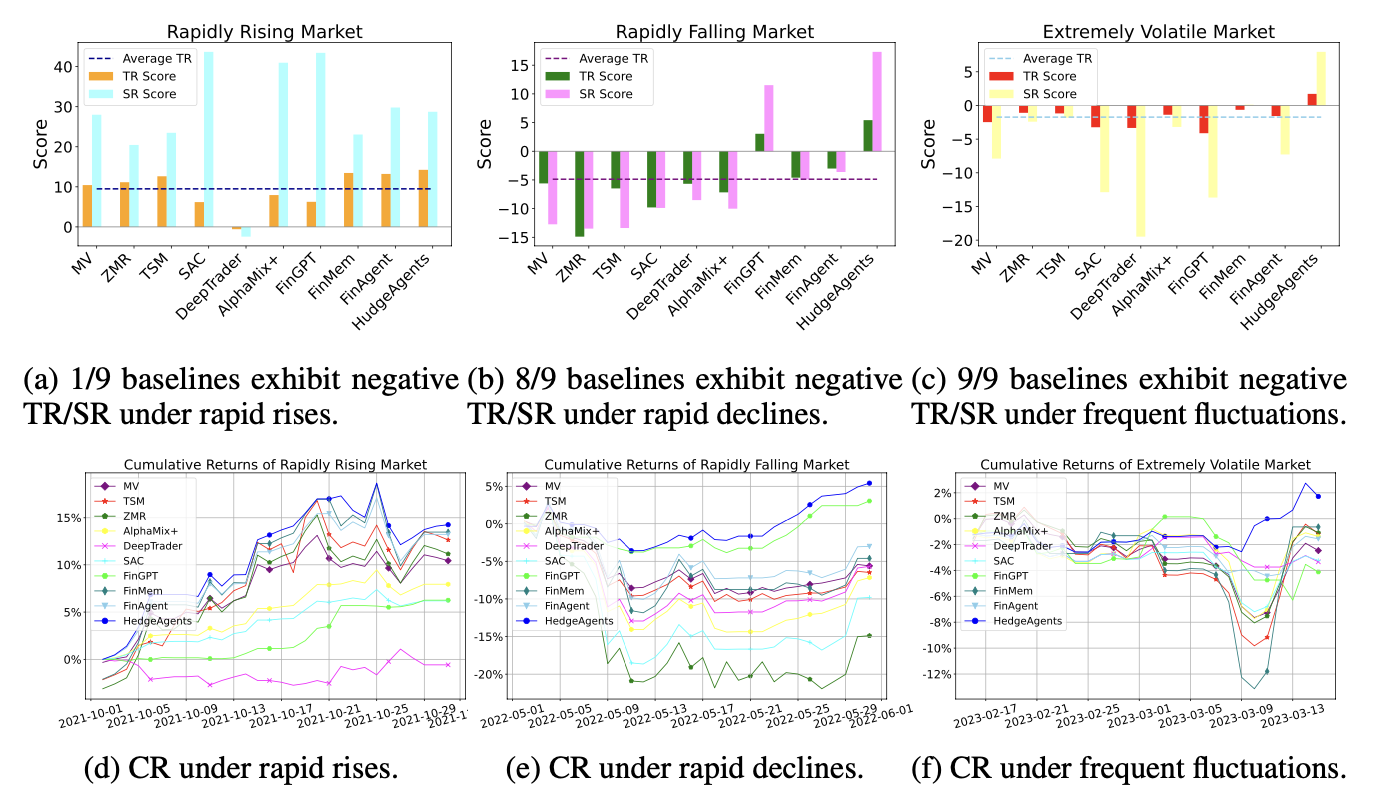

Cumulative Returns Comparison of our HedgeAgents and all baselines